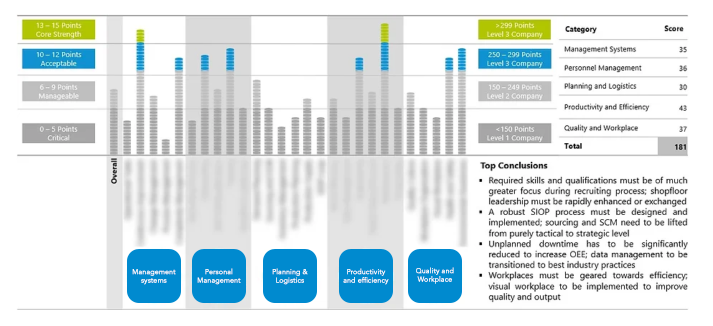

POWERFUL OPERATIONS SCORECARD

INTERIM C-SUITE AND SENIOR MANAGEMENT

Engineer Growth That Keeps Pace With Ambition.

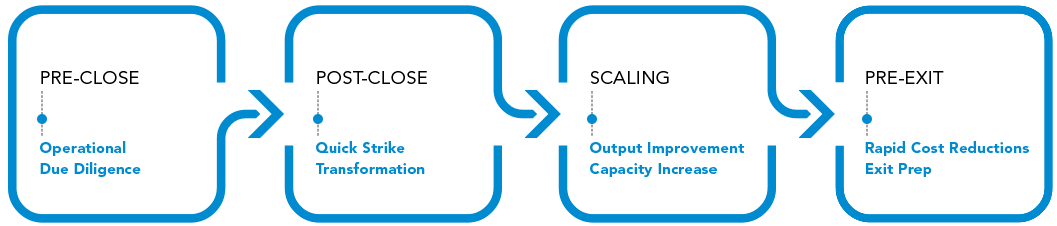

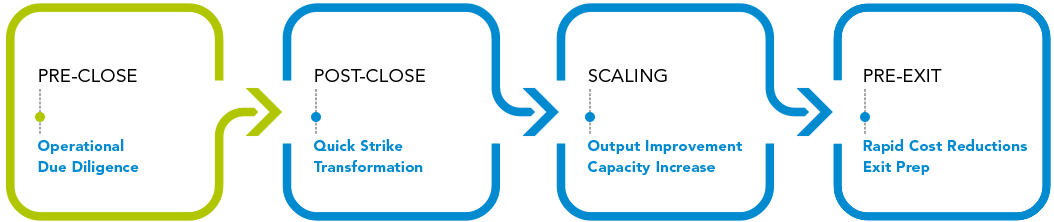

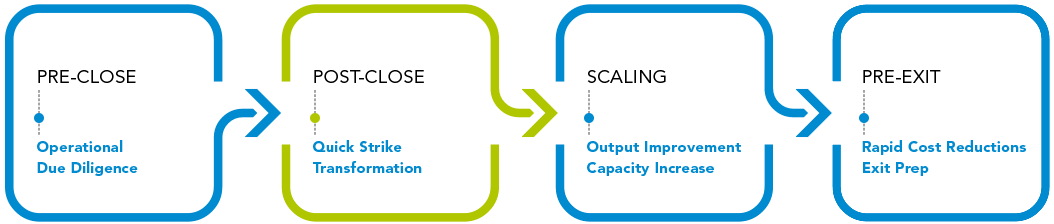

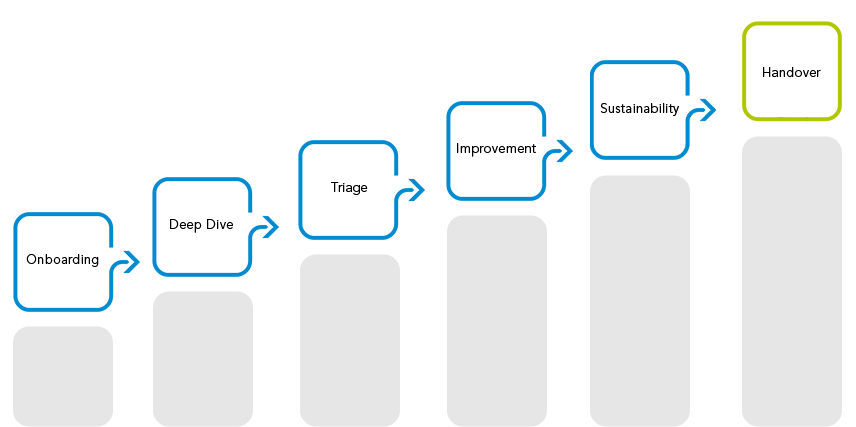

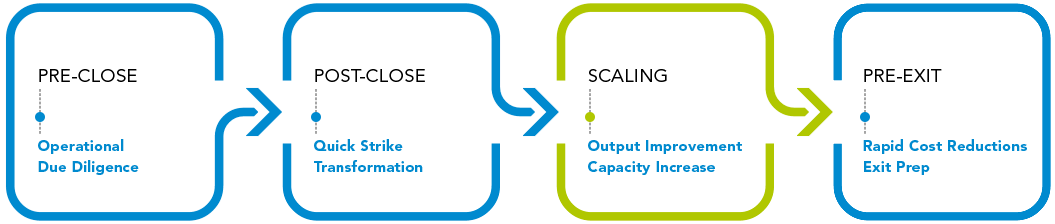

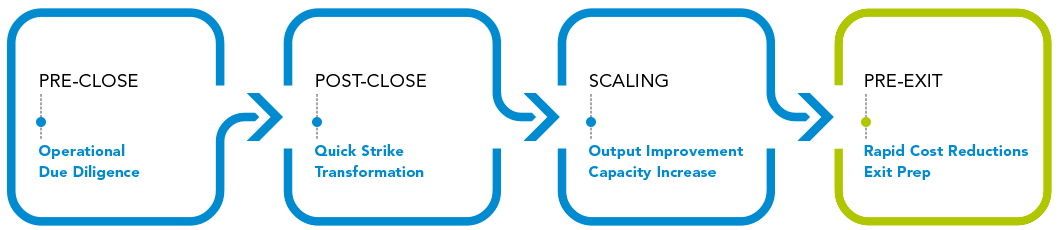

Growth demands more than capital. It requires capability. We help scale operations by identifying process constraints, optimizing layouts, and integrating automation where it accelerates ROI. Our structured playbooks increase capacity without adding unnecessary complexity.

STREAMLINERS : Tools that Drive Value. Solutions that Deliver.

As exit approaches, Streamliners aligns every lever toward enterprise value maximization. We implement precision cost takeout, operational streamlining, and agile restructuring to enhance margins and reveal hidden value. The result is a business that delivers consistent performance and commands a premium at exit.